TLDR

- ARK reports that institutional entities now hold 12.2% of Bitcoin’s total supply.

- Bitcoin’s on-chain signals show strong demand with long-term holders maintaining positions.

- Mid-sized investors have been adding to Bitcoin positions, supporting rally stability.

- Macroeconomic shifts and easing inflation may further boost Bitcoin demand.

Bitcoin’s core fundamentals remain strong as the cryptocurrency enters the final quarter of 2025, according to ARK Invest. The firm notes that on-chain metrics, such as network activity, profitability, and supply distribution, are indicating a positive outlook for Bitcoin’s price performance. As institutional involvement grows and macroeconomic factors evolve, Bitcoin could experience further upward momentum, although some caution remains due to potential market volatility.

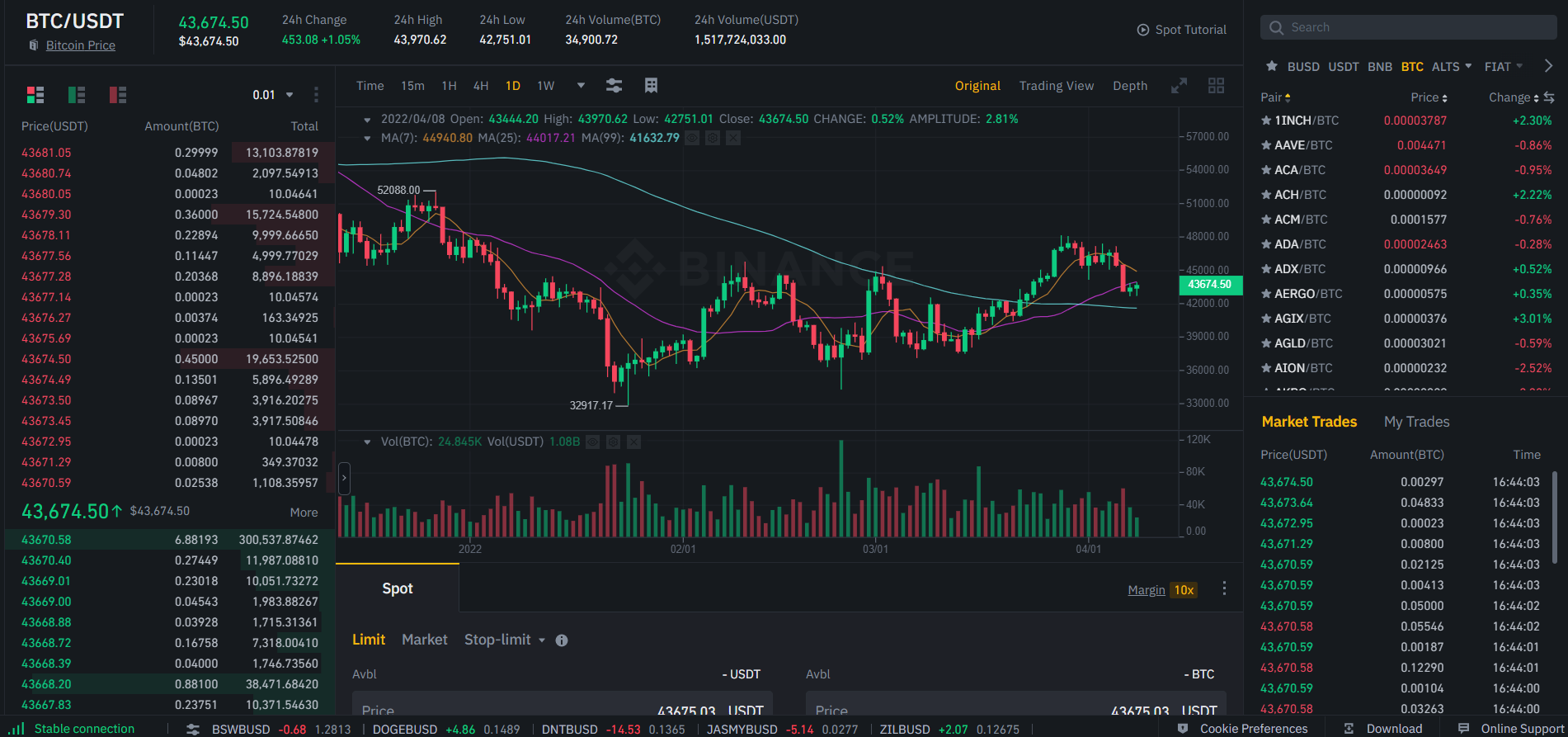

On-Chain Metrics Indicate Strong Demand

In ARK Invest’s recent Bitcoin Quarterly report, the firm pointed to positive on-chain signals that suggest Bitcoin’s fundamentals are holding firm. The data reveals that most of the Bitcoin in circulation is in profit, with long-term holders showing little indication of selling.

ARK Invest notes that this behavior has historically coincided with bull market phases. Additionally, the majority of Bitcoin is held by investors with a low propensity to sell, which has contributed to a more stable market.

The report also highlights the increasing role of mid-sized investors in recent months. These investors have been steadily adding to their Bitcoin positions, signaling renewed confidence in the market. Combined with a slowdown in selling from larger holders, this could suggest a more organic market rally, less reliant on speculative trading and more driven by long-term holders and institutional interest.

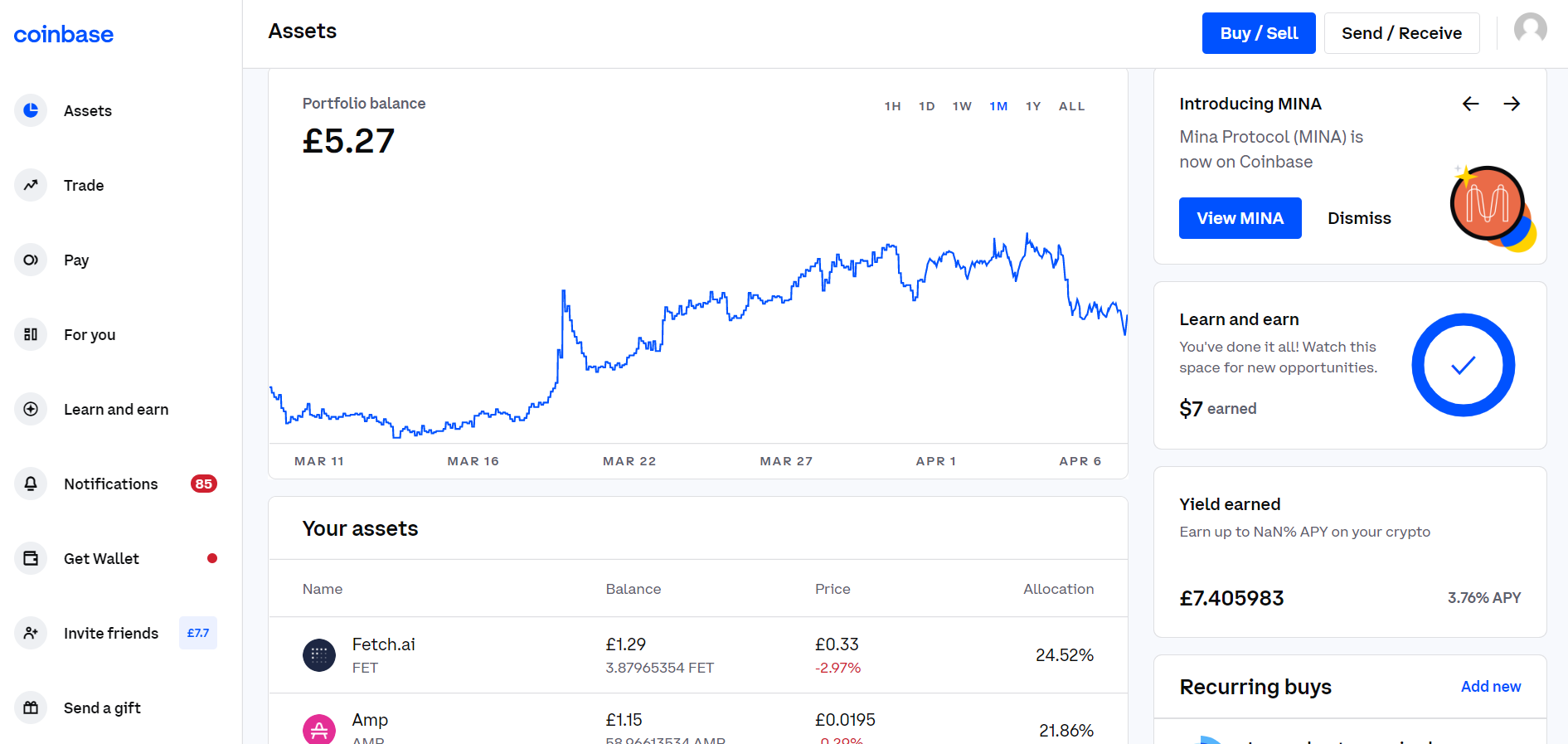

Institutional Adoption Reaches New Heights

ARK Invest also points to the continued growth of institutional participation in Bitcoin. The firm reports that institutional entities, including digital asset trusts and Bitcoin exchange-traded funds (ETFs), now hold over 12% of Bitcoin’s total supply. This marks a record level of institutional ownership and reflects Bitcoin’s increasing integration into traditional capital markets.

According to ARK, this rising institutional presence is beneficial for the market as it provides more stability and lessens the reliance on retail-driven volatility. Furthermore, regulated investment vehicles like ETFs and trusts continue to absorb new Bitcoin supply, which could result in a tighter available float. As more institutions add Bitcoin to their portfolios, the asset may become a more recognized component of diversified investment strategies, potentially driving further demand.

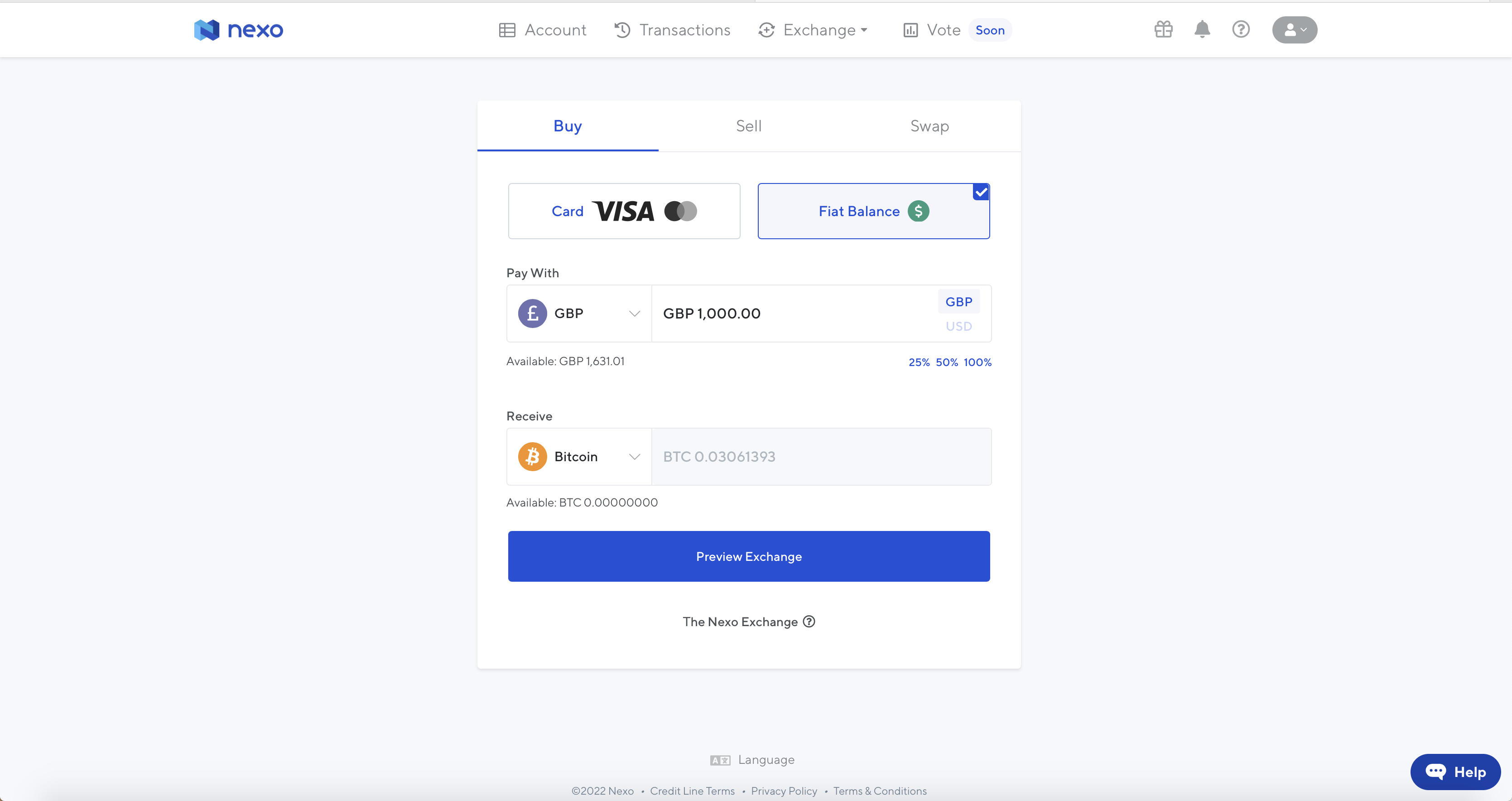

Macroeconomic Factors Could Support Growth

In addition to on-chain data and institutional involvement, ARK Invest highlights macroeconomic trends that could further benefit Bitcoin. The firm notes that inflation is under control and signs of a weakening labor market are encouraging a shift in Federal Reserve policy. This shift, along with possible government moves towards deregulation and tax reductions, could create a favorable environment for risk assets like Bitcoin.

ARK suggests that these conditions, along with an improving macroeconomic backdrop, could lead to “productivity-led growth.” This environment has historically been supportive of risk assets, including Bitcoin, and could reinforce the positive signals already seen in the market. If these trends continue, Bitcoin’s demand could be further boosted as we approach the end of 2025.

Caution on Market Cycles

While ARK Invest maintains a bullish outlook for Bitcoin, the firm also cautions that timing will play a critical role in the market’s performance. The report notes that historical market cycles suggest there may be periods of increased volatility or consolidation. Although the fundamentals are strong, ARK warns that investors should be prepared for potential market swings as the market digests recent gains.

Despite this, ARK remains optimistic about Bitcoin’s future, given the strong on-chain signals and institutional involvement. As we move into the final months of 2025, the firm believes that these factors could create a solid foundation for continued price appreciation. However, market participants should remain vigilant, as the timing of market cycles could bring both opportunities and challenges.

ARK Invest’s report emphasizes Bitcoin’s continued strength, both in terms of its on-chain metrics and growing institutional adoption. The firm believes these factors, combined with favorable macroeconomic conditions, set the stage for potential gains in the fourth quarter of 2025. However, investors should stay mindful of possible volatility as the market continues to evolve.

Bitcoin4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

NFT4 years ago

NFT4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

Bitcoin4 years ago

Ethereum4 years ago

Ethereum4 years ago

Bitcoin4 years ago

Bitcoin4 years ago