Bitcoin

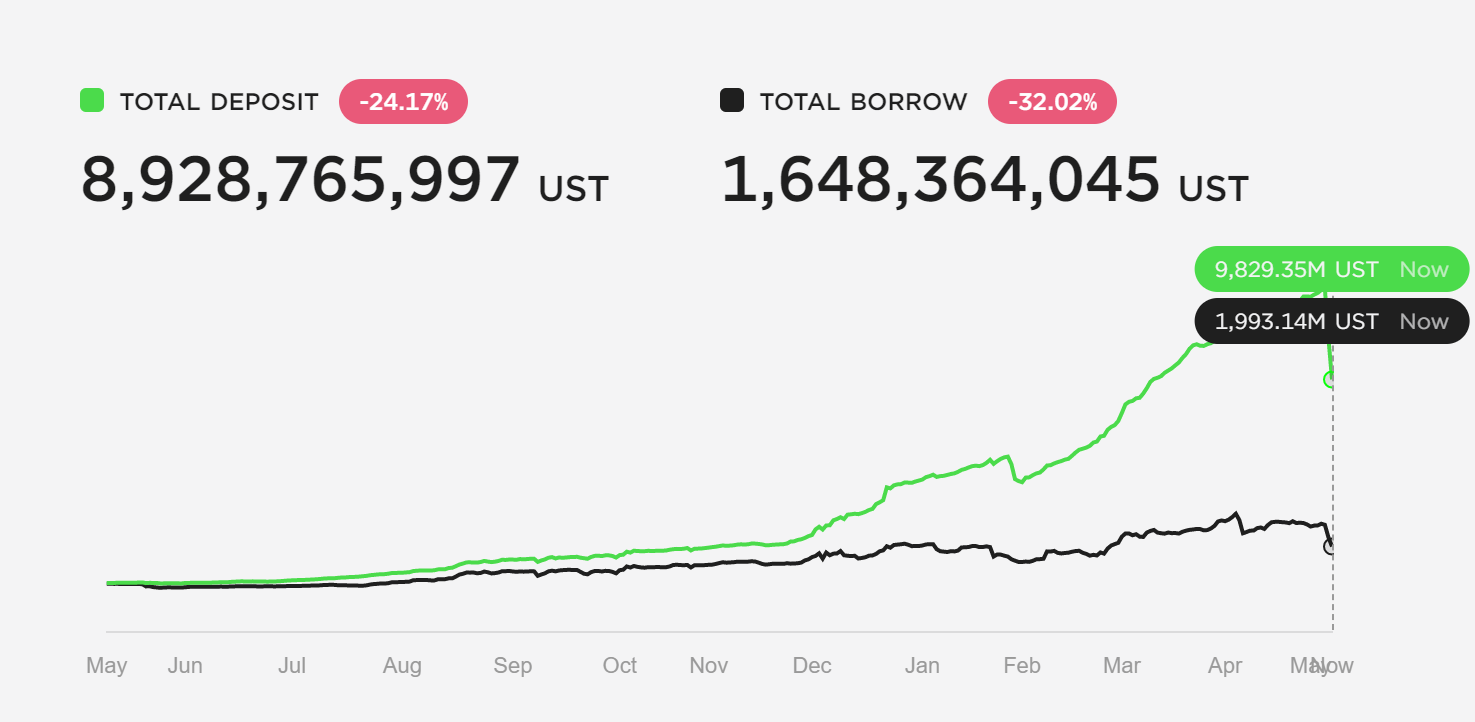

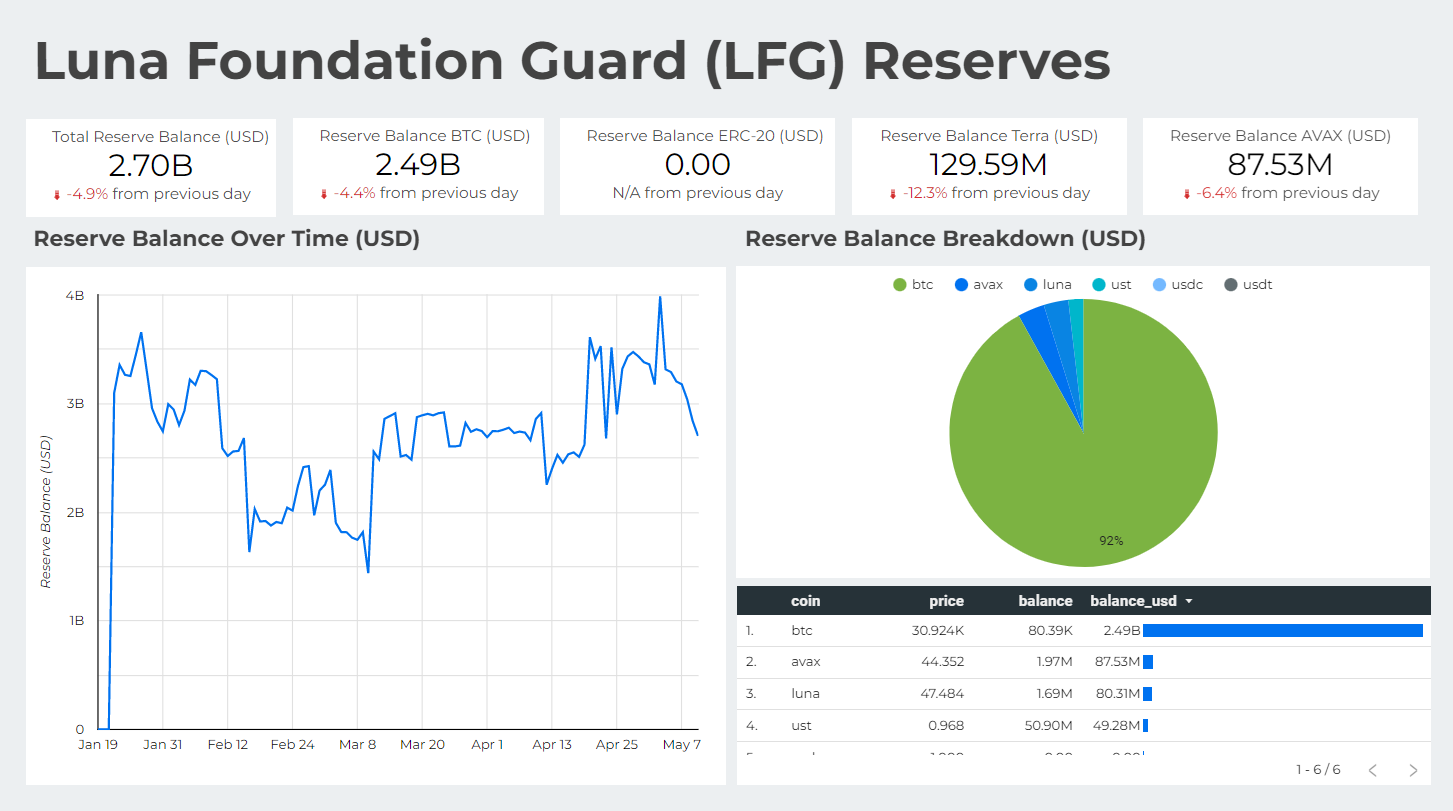

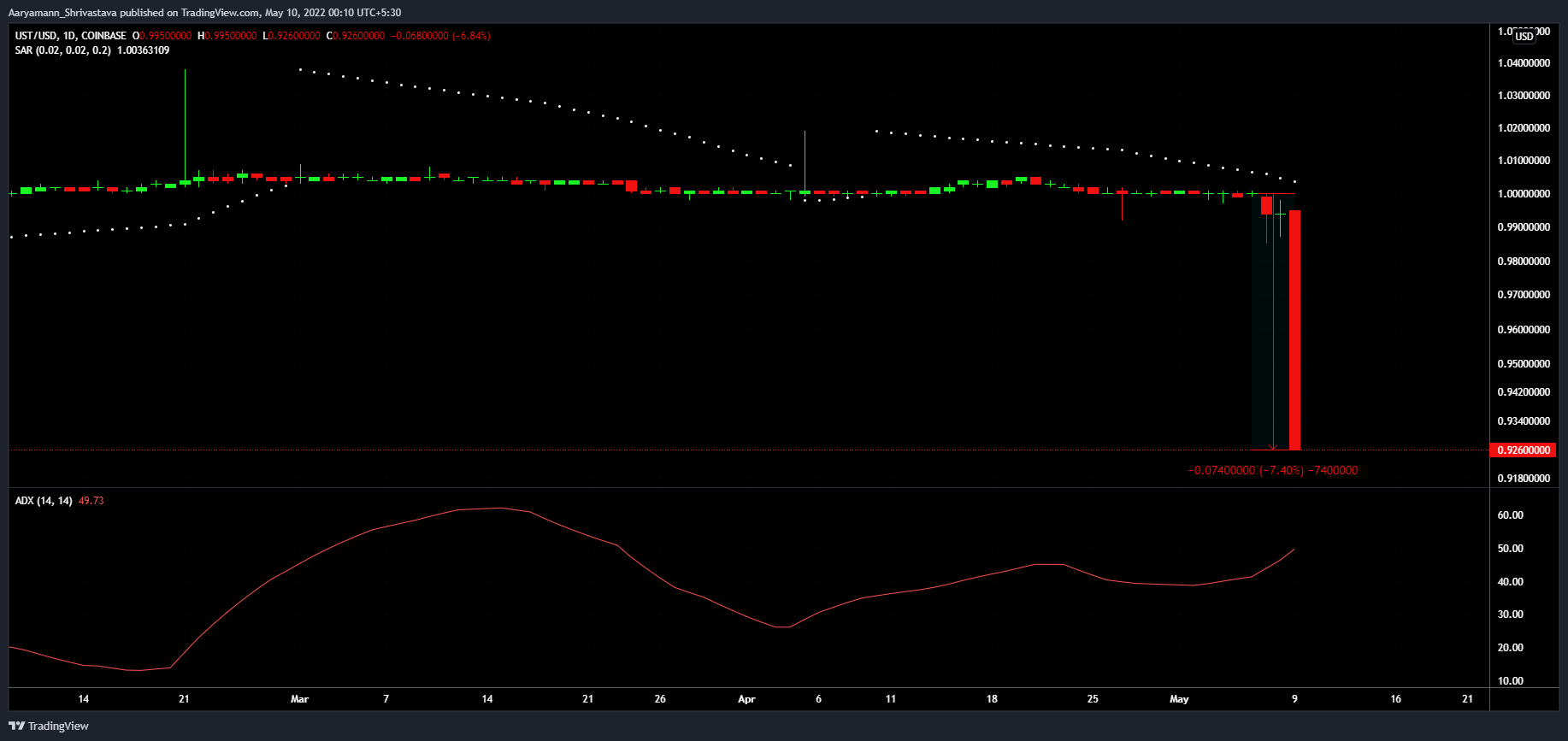

Terra’s LFG Sells $750M of Bitcoin, UST Depegs by 7% (Luna Price Update)

Bitcoin

Shiba Inu’s stability in question; is NuggetRush the gateway to significant gains?

Shiba Inu’s (SHIB) community is excited over a recent partnership with K9 Finance. NuggetRush (NUGX) continues to gain more attention as the official launch of its mining game approaches. NUGX’s value is also up by 100% ahead of its official listing. Shiba Inu’s (SHIB) rising burn rate coincides with excitement over growing DeFi activity on…

Bitcoin

Bitget Wallet Unveils $200,000 Meme Coin Fiesta Following Its Meme Coin Launch

Victoria, Seychelles, April 11th, 2024, Chainwire Bitget Wallet, at the forefront of the Web3 wallet landscape, has recently unveiled a meme coin-themed event, showcasing a substantial prize pool of $200,000. This move comes on the heels of the successful launch of its meme coin, MOEW, on the Base mainnet. This experimental token launch marked a…

Bitcoin

Bitcoin Technical Analysis: Bulls Push Forward, Breaking Upper Resistance Levels

-

Bitcoin2 years ago

Bitcoin2 years agoDigital Currency Group wraps up $600 million debt capital raise

-

Bitcoin3 years ago

Bitcoin3 years agoWhere to buy Dogelon Mars after falling 15% on Thursday

-

Bitcoin2 years ago

Bitcoin2 years agoAre you a Star Atlas fan?

-

NFT3 years ago

NFT3 years agoDRepublic launches a combined NFT platform, ‘MetaCore’ Using EIP-364

-

Bitcoin2 years ago

Bitcoin2 years agoMANA has risen 16%: Here’s where you can buy MANA Coin

-

Bitcoin2 years ago

Bitcoin2 years agoIndian Government Answers Questions about Bitcoin Transactions, Karnataka Scam and Legality of Crypto Trading

-

Ethereum3 years ago

Ethereum3 years agoEthereum prices skyrocket but Ether Gas Fees surge, fueling costly transfers

-

Bitcoin2 years ago

Bitcoin2 years agoSalvadoran Ecologist Claims Nayib Bukele’s Volcano-Powered Bitcoin Mine Will End in Environmental Disaster’